Bubblesong

Contributor

PLEASE! Get quotes from other insurers!!!

I shall tell you my story;

I had Liberty insurance based on a “better price than the insurers AAA” was agent for, (AAA is not the insurers, just agent for Commerce at the time).

Over time, Liberty just kept going up, but we thought it was due to 2 kids driving, three cars Massachusetts, good coverage. Once early on, we tried Geico, but they used a bait and switch, price went from $1200 to$2400 after we gave credit card so we cancelled and continued to get bled by Liberty until 2022, when the bill was increased to $9,000.

Hell no.

We gently told our daughter to get her own insurance, and we’d get our own.

Liberty quoted her $3,000, State Farm was $1200 in Texas.

Back in Mass, Liberty quoted us 3 people, 2 cars, $7k without the daughter or her car. But Amica was $2,000.

FIVE thousand dollar difference for same coverage, line by line!!!

Also Vets can get even better insurance that non vets can, so please, shop around, to keep insurance companies from fleecing people!

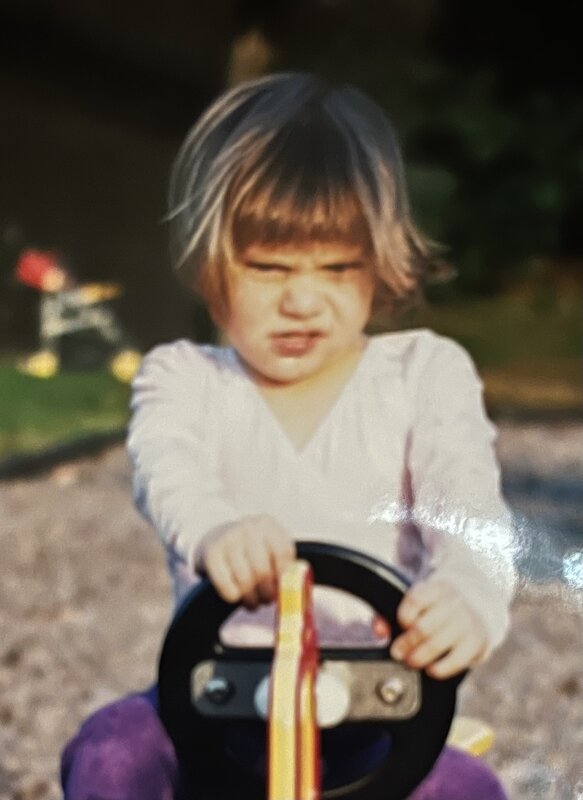

My daughter the new driver:

I shall tell you my story;

I had Liberty insurance based on a “better price than the insurers AAA” was agent for, (AAA is not the insurers, just agent for Commerce at the time).

Over time, Liberty just kept going up, but we thought it was due to 2 kids driving, three cars Massachusetts, good coverage. Once early on, we tried Geico, but they used a bait and switch, price went from $1200 to$2400 after we gave credit card so we cancelled and continued to get bled by Liberty until 2022, when the bill was increased to $9,000.

Hell no.

We gently told our daughter to get her own insurance, and we’d get our own.

Liberty quoted her $3,000, State Farm was $1200 in Texas.

Back in Mass, Liberty quoted us 3 people, 2 cars, $7k without the daughter or her car. But Amica was $2,000.

FIVE thousand dollar difference for same coverage, line by line!!!

Also Vets can get even better insurance that non vets can, so please, shop around, to keep insurance companies from fleecing people!

My daughter the new driver: