Nope. It's business as usual.Wouldn't this be considered fraud or some sort of a crime?

Who was defrauded? It's a private company. The fired employees got screwed but they have no rights beyond whatever separation payments were required by the government where they were employed. The lenders will presumably lose money, but unless Montagu lied to them about the company's financial situation, they can't claim they were defrauded. It's their own fault for making a bad decision.

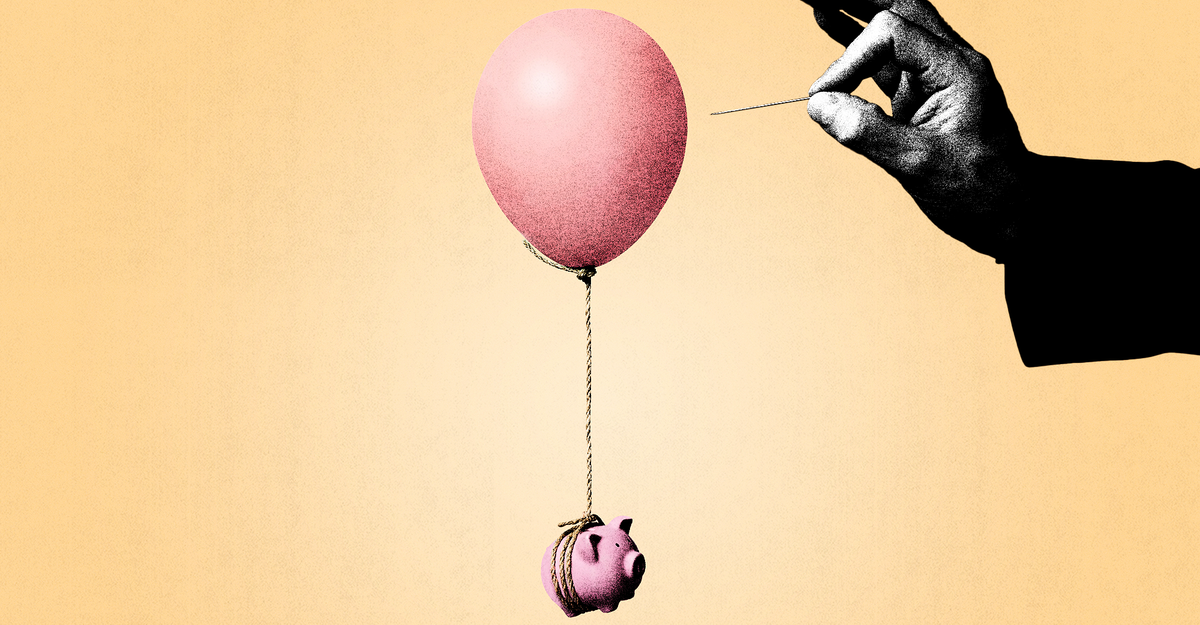

Wonder why lenders make these decisions? It's the classic misalignment of incentives. In the short term, making a big loan provides immediate income from fees and asset growth for the lender, both of which tend to increase the lender's stock price and, more to the point, result in large bonuses and sometimes promotions for the lender's managers and executives. Years later, when it becomes clear that the loan was a bad idea, the bonuses have been spent and the individuals involved have likely moved on. Of course, too many bad deals will eventually sink a financial institution, but the wonder of capitalism is that it really is an efficient way to create economic surplus. This surplus generally means that it takes more than the usual levels of greed and stupidity for financial institutions to be unprofitable despite the occasional bad deal. Especially as most of the surplus flows to the participants who already control the most capital.