Dive shops in Wisconsin and Illinois were targeted this week by a crime ring. The scammers use stolen credit cards to buy Shearwater (Teric or Perdix) or Garmin dive computers. The dive shops were warned, so no crimes occurred. A dive ship in the DC area was hit in December. A NC shop owner said she knows of 30 LDS that have been hit.

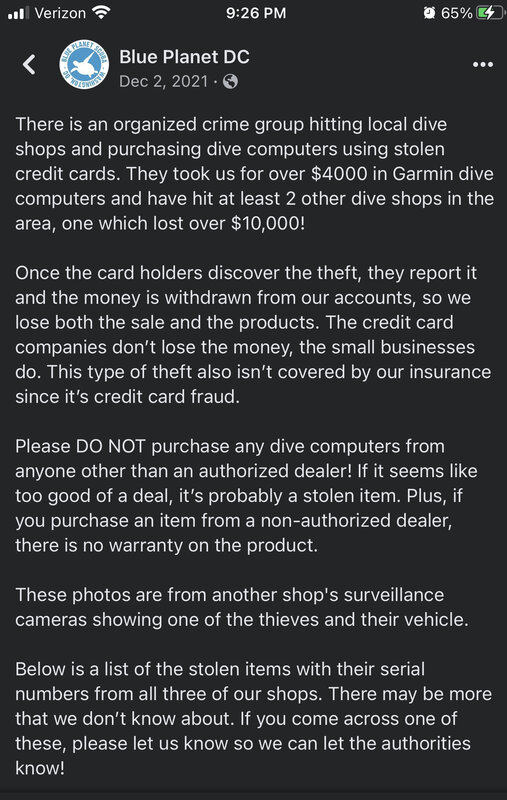

FB post by Blue Planet, a DC area dive shop.

https://www.facebook.com/BluePlanetDC/posts/4820183428002275

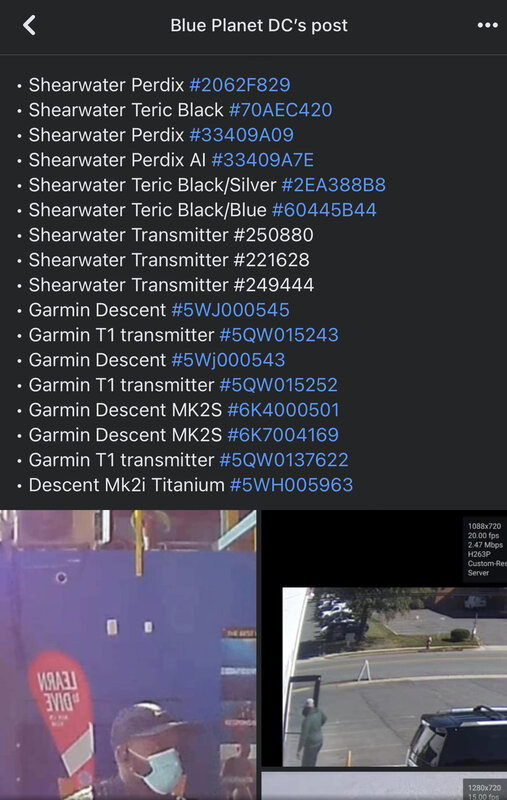

Screen shots follow.

FB post by Blue Planet, a DC area dive shop.

https://www.facebook.com/BluePlanetDC/posts/4820183428002275

There is an organized crime group hitting local dive shops and purchasing dive computers using stolen credit cards. They took us for over $4000 in Garmin dive computers and have hit at least 2 other dive shops in the area, one which lost over $10,000!

Once the card holders discover the theft, they report it and the money is withdrawn from our accounts, so we lose both the sale and the products. The credit card companies don’t lose the money, the small businesses do. This type of theft also isn’t covered by our insurance since it’s credit card fraud.

Please DO NOT purchase any dive computers from anyone other than an authorized dealer! If it seems like too good of a deal, it’s probably a stolen item. Plus, if you purchase an item from a non-authorized dealer, there is no warranty on the product.

Screen shots follow.