mike_s

Contributor

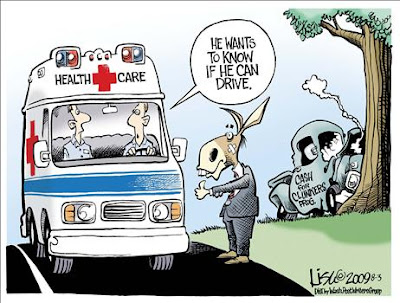

that's funny?????????

nope....

it's also email drivel that is not accurate.

I personally think the "cars for clunkers" is a scam on the taxpayers, but it's not taxable on your federal income tax.

from CARS.gov - Car Allowance Rebate System - Helpful Q&As for Consumers - Formerly Referred to as “Cash for Clunkers”

Is the credit subject to being taxed as income to the consumers that participate in the program?

NO. The CARS Act expressly provides that the credit is not income for the consumer.

However, states might tax it and you pay tax on it when you register your car.

from CARS.gov - Car Allowance Rebate System - Helpful Q&As for Consumers - Formerly Referred to as “Cash for Clunkers”

Do I have to pay State or local sales tax on the amount of the CARS program credit?

MAYBE. The question of whether a consumer must pay State or local sales tax on the amount of the CARS program credit depends on the sales tax law of each State or locality. Consumers should review the law of their respective States or consult a tax advisor to answer this question.