LiquidDivingAdventure

Contributor

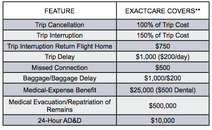

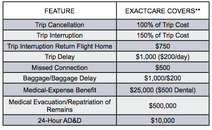

As mentioned in an earlier post, I have started to offer travel insurance from Berkshire Hathaway for my dive client. AirCare provides benefits for air travel only and ExactCare provides benefits for air travel and resort/liveaboard travel. General coverage in a table image below. With BH, claims may be submitted via a smart phone app. I asked the company about this specific incident and here is the response:

There are several ways coverage could apply to the incident, remember all claims cannot be preapproved via email and this client would have to go through a standardized claims process.

AirCare:

If this client had purchased an Aircare policy, this incident would have to cause a delay to their next flight segment and the delay would have to be 2hours or more. However the benefit would be paid within a couple of minutes equaling $50 and there is the possibility of capitalizing on the missed connection benefits as well, at $250 if this incident causes them to miss their next flight segment connection.

ExactCare:

If this client had purchased an exact care policy, and the weather caused a trip delay of 5 Hours or more, they would be reimbursed for reasonable additional expenses equaling $200 per day, but not exceeding 1000 per trip so typically hotels and food. This can also be covered under trip interruption, a delay or cancellation of the trip caused by inclement weather, usually interruption comes into play, if the traveler missed a portion of the scheduled itinerary. In this situation they can be paid a max benefit of 150% of total trip cost.

Both Policies:

If this person decided to purchase both AirCare and ExactCare they would be paid full benefits from both policies. AirCare providing funds now when the incident occurs and ExactCare pays on a reimbursement basis usually 48-72 hour grace period.

There are several ways coverage could apply to the incident, remember all claims cannot be preapproved via email and this client would have to go through a standardized claims process.

AirCare:

If this client had purchased an Aircare policy, this incident would have to cause a delay to their next flight segment and the delay would have to be 2hours or more. However the benefit would be paid within a couple of minutes equaling $50 and there is the possibility of capitalizing on the missed connection benefits as well, at $250 if this incident causes them to miss their next flight segment connection.

ExactCare:

If this client had purchased an exact care policy, and the weather caused a trip delay of 5 Hours or more, they would be reimbursed for reasonable additional expenses equaling $200 per day, but not exceeding 1000 per trip so typically hotels and food. This can also be covered under trip interruption, a delay or cancellation of the trip caused by inclement weather, usually interruption comes into play, if the traveler missed a portion of the scheduled itinerary. In this situation they can be paid a max benefit of 150% of total trip cost.

Both Policies:

If this person decided to purchase both AirCare and ExactCare they would be paid full benefits from both policies. AirCare providing funds now when the incident occurs and ExactCare pays on a reimbursement basis usually 48-72 hour grace period.